Production and Work

We have blundered in the control of a delicate machine, the working of which we do not understand.

—John Maynard Keynes (1930)

This first section updates and simplifies Marx’s original theory of capital and class. International and national banks may dictate global economic policies today but production and reinvestment of profits in fixed capital and a skilled workforce are still the heart of an efficient economy. Though much less work is physical today, we still need people to get out of warm beds each morning motivated by the return on their contributed labour or capital.

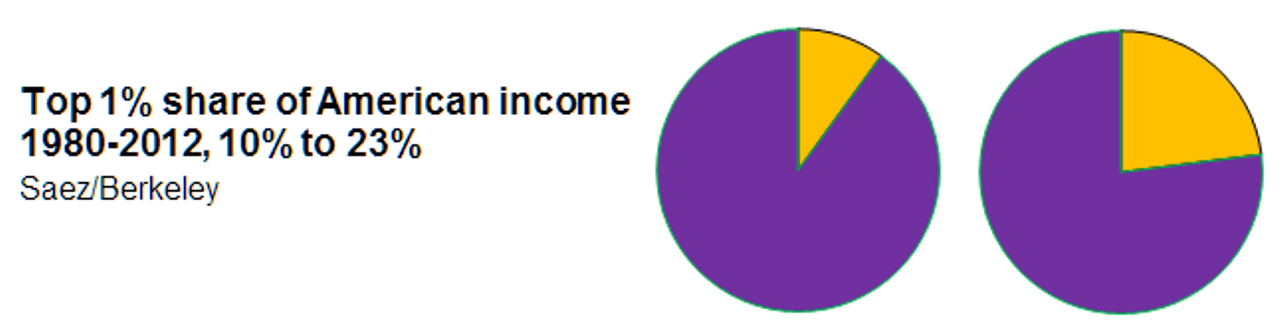

Chart 4: Rising inequality, 1980 to 2012

Marx’s original analysis claimed only labour produced new value and labelled all return on capital as theft, encouraging the revolutionaries of 1840. Today we are content to see a reasonable return to capital provided we benefit from capitalism’s investment in efficient production.

Waged workers still need to organise as a distinct class to gain a fair share of production, but their willingness to do this has reduced over the past thirty years of debt-funded affluence and complacency. When I first worked in 1970s New Zealand, the annual battle between labour and capital over the wage round was much more visible. The resulting economic cycle was predictable—good years created large profits leading to visibly extravagant spending by the rich; big unions then led a catch-up with coordinated annual campaigns; wages went up and profits went down leading to a recession; wages went down, profits up and we started all over again.

The inefficiency of this obvious cycle was easy to criticise, as were the excessive rewards for unions in industries vulnerable to strikes, but the removal of union rights has produced new extremes. It turns out there is no limit to the excess which capital and management can agree together when strikes are restricted and regulation is removed. Inequality has reached ridiculous levels, with executive equity packages encouraging boards to favour short term share-price increases over the long term viability of their corporations and increasingly their nations.

In 2008 we were forcibly reminded by the global financial crisis that western economies and workers are vulnerable. The value of professional and participatory unions is clearer in these newly uncertain times but laws need changing, cultures rebuilding and this takes time. Today’s underemployment and long term unemployment creates costs for capital too; lost profits from underproduction, plant write-offs, lost workplace skills and new training costs.

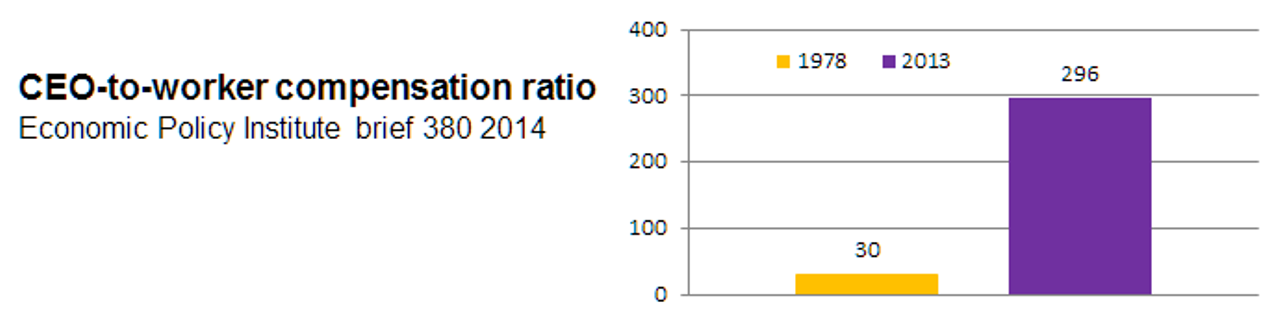

Chart 5: Income for staff and executives, 1978 to 2013

Governments face the most critical challenges. In addition to the cost of unemployment support and increased political instability, states are expected to fund restructuring and restimulating the economy. These are huge cost burdens which reduce the long term capacity of the state to support an efficient economy.

Monopoly, inevitably

Free markets are one of the critical preconditions for capitalist efficiency, since competition ensures prices are set according to average costs of production and profits. Free markets may be efficient according to mainstream economic theory, but in practice unregulated large scale producers have a natural tendency to seek higher profits by creating monopoly or its close cousins, market dominance, integrated supply chains and cartels. Competitors are driven out allowing overcharging; control of the distribution chain squeezes suppliers; large players collude on price setting. You can see this in your local neighbourhood when large chains cut prices – until they’ve killed the competition.

These last three decades of globalisation have encouraged massive industrial consolidation, mainly through international mergers and acquisitions. One hundred giant firms from high-income countries now fund more than 60% of global research and development expenditure among the world’s largest companies; two or three integrated firms dominate each high-tech high-added-value industry (p134 Nolan); twenty nine global banks are deemed systemically critical, according to the Bank for International Settlements.

After the global financial crisis, capital-friendly governments chose bailing out over breaking up these “too big to fail” corporations. Nations are being pressured to sell off state assets and fund infrastructure to re-stimulate growth when they should be retaining a role in natural monopolies, both to prevent excess private profits and to strengthen their own income base. Regulation and state monopolies do reduce optimum theoretical efficiency, but not nearly as much as monopoly in practice.

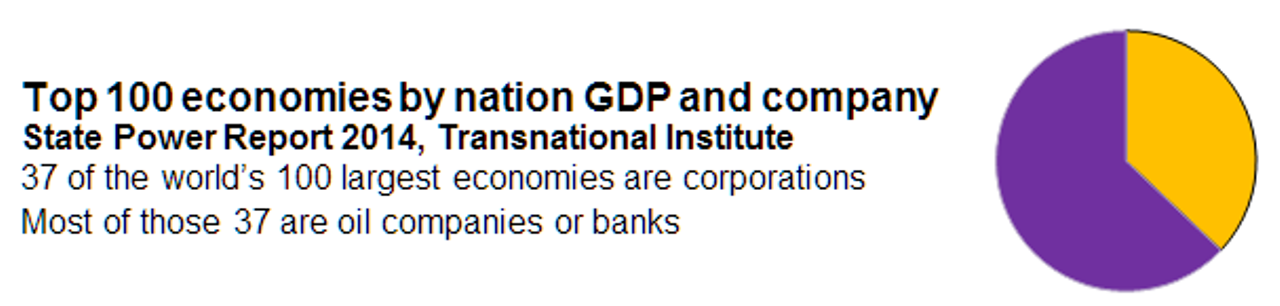

Chart 6: Corporations as share of top 100 global economies

“Is China buying the world?” Peter Nolan:

The global business revolution saw for the first time the emergence of wide-spread industrial concentration across all high-income countries, as well as extending deeply into large parts of the developing world (p17).

The foreign assets of the world’s 100 largest multinational companies are 57 per cent of their total assets, foreign employment amounts to 58 per cent of total employment, and foreign sales amount to 61 per cent of total sales. Between 1990 and 2009, the stock of outward foreign direct investment from the developed countries increased more than eightfold (p39).

In 2010 there were seventy-nine firms from low- and middle-income countries in the world’s largest 500 firms. However, this is still a small number in relation to the population of developing countries. Moreover, such firms are concentrated in a narrow range of sectors, including twenty-three banks, sixteen oil and gas producers, eleven metals and mining companies, and nine telecommunications service companies. Most of these operate in protected domestic markets and are often state-owned enterprises which cannot be acquired by multinational companies. Moreover, these are sectors that do not generate new technology (p49).

Global firms, with their headquarters in the high-income countries, are increasingly ‘inside’ the developing countries, typically occupying commanding positions within their business structure in high value-added sectors. This poses a serious policy challenge for developing countries (p135).

Foreign investment

Capital improves our future economic prospects by reinvesting profits to improve productivity, but not all capital is equal. While removing regulation of foreign direct investment is regularly promoted as essential to boost growth, understanding the pros and cons of foreign investment is critical to evaluating successful national economic strategies.

There are enormous trade-offs over the long run between foreign-fuelled growth and support for domestic companies—between faster growth now and future income streams exiting the country, short term financial profit and long term competitiveness, domination by foreign controlled transnational supply chains, revenue and tax shifting across global corporations. And the downside costs of foreign investment in developing countries will be much higher in this era of stimulus-driven bubbles and crises, derivatives and carry trades, global corporations and tax avoidance.

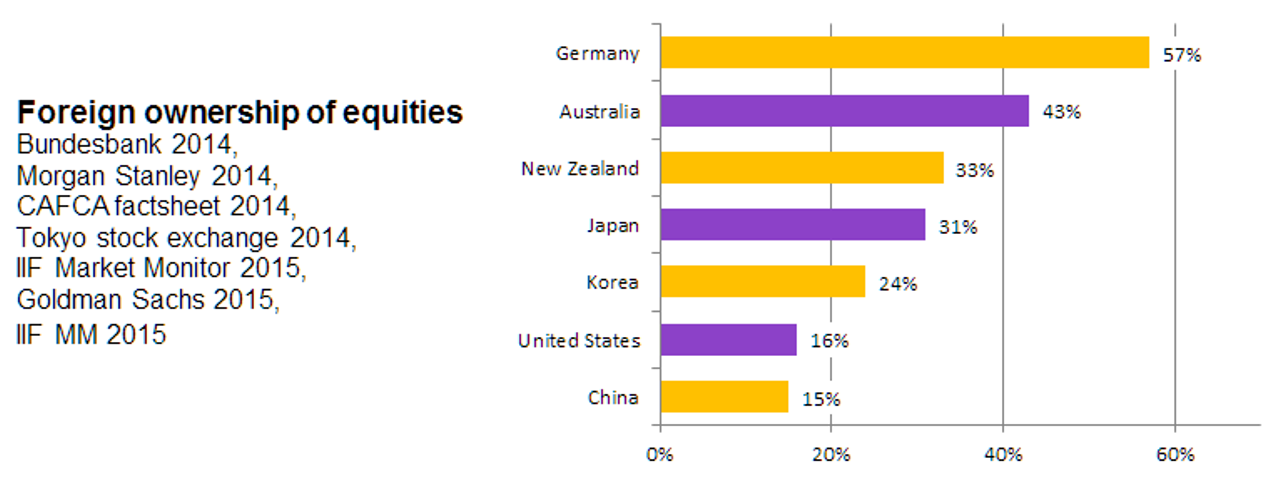

Chart 7: Foreign ownership in nations with published data

Fortunately, global corporations still face barriers to expanding into new countries; it is always easier to grow a business at home than abroad. Skilled staff are harder to source, cultural knowledge helps product targeting, regulatory barriers favour well connected local companies, profits are harder to repatriate, prospects less certain. Consider the tobacco industry, happy to take monopoly profits from addiction in affluent countries, but ignoring the vast potential profits in developing countries until forced to diversify by western anti-smoking laws. And buy-local campaigns are even more appealing when multinational corporations avoid paying their share of taxes.

The home advantage was used very effectively after 1950 by nations like Japan, Korea and now China to grow faster than the west. Behind all the hype though, there are still only nine Chinese firms in a survey of the world’s 1,400 largest companies and none in the top 100 (2010, Nolan p66). Foreign invested firms now account for around 28% of the China’s overall industrial value-added, 55% of exports and 90% of high-technology exports (p93).

Reducing trade barriers and increasing specialisation for export certainly benefits transnationals, creating an open global market where it is easier for their scale and integration to outcompete national producers. While there are efficiency gains for nations too, at some point the costs and risks outweigh the benefits. Costs include lost national control of economies and jobs, increased volatility and change costs, reduced security of employment and rising work intensity, more and more workers forced to abandon their home and culture to travel for work, and a gradual decline in the depth of national cultures. That cultural shift might appear benign today, when we are swapping our old ways for new wealth and consumer goods—but what if that new wealth is illusory and our debt-binge runs dry, leaving us with more ruthless employers and tougher working lives?

Western economists and global banks also advocate loudly for free “capital markets”—the absence of government regulation on international capital flows—for developing nations. They don’t mention that home-grown investment was their own path to early development, when colonial dominance gave the west influence to limit overseas competition from indigenous producers.

In 2014, the world’s wealthiest one percent held 48 percent of global wealth (Oxfam, 2014) and controlled the leading global corporations. Many countries already have 30% of their economy owned overseas and net foreign capital inflows to developed nations grew an average of 9.7% every year between 2000 and 2013 (UNCTAD foreign investment database).

Do we want a world where every company is owned “offshore” and paying as little taxes as they can get away with? Where a large share of profits come from global short term betting and national instability? Where every country specialises for export to global markets and the pool of migrant workers soars? Pause and think about that future world, because that is where we are heading today.

“Is China buying the world?” Peter Nolan:

The fact that firms with their headquarters in high-income countries have been buying the world to construct global business systems poses complicated, severe and little-understood challenges for political economy in the high-income countries. The close identification of large corporations with the particular country in which they have their headquarters has greatly weakened (p135).

Financial vampires

In the last century, capital was legislated into classes. Saving banks were granted a monopoly on managing cash deposits, in exchange for limits on the size and risk of their lending. Under those rules governments were rarely called on to guarantee people’s savings after bank defaults. Investment banks could take greater risk with the funds of the wealthy, but without a government guarantee.

Under deregulation and “financial innovation” this sensible division unravelled rapidly. Savings banks loaned for housing to people who couldn’t sustain a mortgage, but believed the price would always go up. Investment banks packaged and onsold the future income of mortgages and other debts (derivatives), hiding the increased risks off balance sheets. Banks followed suit as the profits got too tempting to ignore, and no-one was left with a direct interest in the soundness of the lending.

The old also benefited, cashing out their big city homes at retirement. Here we saw another type of class created. A whole generation becomes a distinct group which benefits from rising house prices, ensuring favourable policy settings and creating a widespread social pattern of investment behaviour which is hard to change. Tax is forgone and housing incentives dispersed to keep the bubble economy going, leaving less money for productive investment in affordable housing, small businesses and long term equity. The young are left to gamble their life’s savings against cyclical markets.

Derivatives grew spectacularly, becoming a tool for international speculation by increasing the gains and losses for contracted events. “Carry trades”, short term bets on future prices around the globe, made world prices and national currencies more volatile and increased the pressure on productive companies to buy hedging (future prices insurance). Hedging fees to investment banks and profitable bets on volatility by hedge funds both grew; profits from western production were maintained only by reducing real wages.

Hedge funds flourished by offering short term investment products to the emerging class of super rich, whose wealth and tax avoidance reduced their concern for economic stability. Global audit firms found new ways to shift corporate profits to tax havens and global financing arrangements got a whole lot more complex, relying on private markets with minimal capital. Highly leveraged investment banks joined the list of corporations deemed “too big to fail”.

“Extreme Money” Satyajit Das:

Derivatives include “futures” (price guarantees) and “options” (price insurance). Derivatives are excluded from the balance sheet since all payments are in the future, so they can be used to circumvent accounting regulations, investment rules, securities and tax regulation (p241-2).

Proponents argue that derivatives are used principally for hedging and arbitrage; they are essential to risk transfer, savings, investment and lowering the cost of capital. But volumes of derivative products traded are inconsistent with hedging. In the credit derivatives market, at the peak, volumes were in excess of four times outstanding underlying bonds and loans. While they can be used for hedging, derivatives are now used extensively for speculation, manufacturing risk and creating leverage. In reality, derivatives are used to provide leverage to investors and corporations, increasing gains and losses for a particular event, such as a change in market prices of an asset, in accordance with customer requirements (p271).

Between 1980 and 2008 the total debt of US financial firms grew from around 20% of GDP to over 100% and in the UK to more than four times the country’s GDP (p320).

There is no simple, painless solution. The world has to reduce debt, shrink the financial part of the economy and change the destructive incentive structures in finance. Individuals in developed countries have to save more and spend less. Companies have to go back to real engineering. Governments have to balance their books better. Banking must become a mechanism for matching savers and borrowers, financing real things. Banks cannot be larger than nations, countries in themselves. Countries cannot rely on debt and speculation for prosperity. The world must live within its means (p441).

Today a “shadow banking sector” offers securitization of future income streams like debt repayment, short term corporate debt funding, sale and repurchase agreements for securities (agreements related to debt or equity), sale and repurchase agreements for derivative contracts (agreements to purchase assets at agreed dates, rights to future purchases without obligation), mutual funds which deal in short term debt, non-bank and investment banks (banks which specialise in purchase, restructure and sale of corporations), as well as those institutions and markets which provide traditional banking functions—all without the banking system’s regulated deposits as backing.

The US and Netherlands have the largest shadow banking systems at 170% and 150% of bank assets respectively. South Africa and Mexico have the largest shadow banking systems among developing economies at 66% and 56% of their bank assets respectively. China’s sector is 30% with the average among the 20 largest nations 50% (Financial Stability Board, JP Morgan). Recent estimates for the size of the shadow banking sector range from $67T (Financial Stability Board) to $100T (Fiaschi), similar to the value of annual global world product of $72T (IMF, all figures 2012).

Many parts of these new financial markets operate with short term funding, which disappears in times of crisis. Since these firms have minimal personal capital at stake they have no incentive to minimise risk and when the crisis hits they have no capital to cover losses, which must be borne by the productive economy. After the 2008 crisis, far too little was paid by investors who had pocketed the benefits of past short term profit seeking.

If governments limit shadow banking and derivatives, requiring them to set assets aside to cover future losses created by their risk-taking, risk and speculation will reduce. If governments continue to treat shadow banking institutions as too big to fail and too hard to break up, capital markets will continue to back their speculation through every boom and expect a bailout in every bust. Financial capital will always exist at the limits of the law, since subverting the law is part of their core expertise.

All sorts of institutions have become dependent on financial products; tax-avoidance states, governments hiding spending off the balance sheet, stateless multinational corporations and private hedge funds, speculative short term traders, shareholders seeking quick returns regardless of risk, housing speculators profiting from cyclic upswings.

Then there is the global dimension to shadow banking; huge corporate profits flow to America, England and Germany, the countries which control the agencies of global governance and lead the economic debate. Reining in the financial sector will not be easy.

Growing instability

You can see a clear break point in long run global GDP growth after 1973, when the average fell from 5% to 3%. This followed the end of the Bretton Woods system and the emergence of floating exchange rates, with exchange rate volatility increasing from a long run average of 2% to 10% (Skidelsky p120). Competition from newly industrialised countries also fed into raw material price hikes in steel and oil. Instability and cost pressures combined to push global unemployment up around the world and keep it at the new levels.

This was the critical point, where the conditions were set to create today’s economy. Governments could have continued on a path of incremental policy development, or transitioned beyond the old cycle of excess and recession, economic fine-tuning and regulation. Instead, political parties in America and England adopted an explicitly pro-capital agenda, ending the blunt counter-balancing force which labour had wielded to maintain class equity—and male advantage within the working class—up to 1980.

“A History of Interest Rates” Homer and Sylla:

Students of history may see mirrored in the charts and tables of interest rates over long periods the rise and fall of nations and civilisations, the exertions and the tragedies of war, and the enjoyments and the abuses of peace. They may be able to trace in these fluctuations the progress of knowledge and of technology, the successes or failures of political forms, the long, hard, and never-ending struggle of democracy with the rule of the elite, the difference between law imposed and law accepted.

Large capital took full advantage of this new freedom. Incentives for chief executives encouraged profit from new sources—restructuring, offshoring, financialisation of debt. Leveraged buyouts loaded debt on to the new corporations, forcing them to reduce capital expenditure to meet cashflow repayments. “Shareholder value” with its emphasis on inflating the short term share price became more important than productive efficiency. Share markets became more cyclical, so investors valued short term returns ahead of long term prospects. Executives used debt for share buybacks to boost their bonuses.

Each change further reduced companies’ ability to invest for long term competitiveness, but profits were maintained by reducing labour’s power and share of corporate returns. The stage was now set for the shift of production to low wage nations. Profits still flowed in for the shareholders of foreign assets but western workers increasingly depended on the less reliable service industry. Western nations responded to falling consumer demand by increasing credit and debt.

Because national economies were now more specialised and more dependent on exports and imports than thirty years ago, the traditional stabilisation mechanism of currency devaluation was much weaker. Export competitiveness still increased as the exchange rate fell, but import costs also rose. In this global economy, demand and price shocks in one nation are quickly transferred to others.

And the new financial markets, characterised by high fees and low transparency, high leverage and low real assets, can fail overnight when a boom ends, radically repricing real assets and spreading shocks across the global economy. In 2000 the “dot-com bubble” crash-landed and the lack of real profit in the new economy first became obvious. Capital had shifted the playing field too far; a huge share of the returns from production had been transferred from labour to capital and there simply wasn’t enough demand left.

This was the second critical point of the modern era. America led the pro-finance crisis response, with the Bush government increasing budget deficits and reducing interest rates. Loans to indebted consumers and corporations increased, fuelling asset price bubbles and temporary spending—but bubbles always burst.

Economists, who had adopted the economic perspective of the rising financial class, carried on talking about efficient markets and ignored the engine of the economy. Nothing is more important to capitalist production than the efficient allocation of capital investment—this is the future—but everywhere you look in the last thirty years, capital was being systematically misallocated.

After the third crisis in 2008, the Washington-consensus view of sound economic policies moved past ideological bias into fantasyland. America, Japan and England had hit the limit of deficit stimulus and started printing money to buy bonds and safe assets, displacing investors into riskier assets. Called “quantitative easing”, this was presented as a necessary response to high unemployment.

The US, UK and Japan talked publicly about the risk of inflation as a justification, while knowing that low demand in this newly insecure world would keep prices down. More honestly, money printing lowers long term returns on bonds which leads to devaluation of the nation’s currency, increasing export competitiveness and reducing foreign debt. Strong nations profited at the expense of the weak.

Western stimulation became so excessive that “carry trades” became the major form of international “investment”. A carry trade borrows money in one country at a low interest rate and invests it in another at a higher rate. This short term money flows in to ride asset bubbles, investing when currencies are low, then pulling out abruptly to take profits without concern for the social consequences.

Today America still continues ultra-low interest rates, forcing reserve banks around the world to follow or face foreign capital inflows and higher exchange rates. Now all nations have equity and/or property bubbles building to another collapse, only this time there won’t be enough money for bailouts.

The bottom line—most of this new financial activity takes net value out of production, increasing prices to the consumer and instability around the world. It exists primarily to extract profit from one nation’s producers for another nation’s financiers, from the developing world to the western elite, and to avoid taxes.

The analysis presented here is mostly drawn from the referenced books and their critiques of mainstream economics and politics. Where the conclusions arise from the method of class analysis rather than mainstream sources, I’ve highlighted these in separate sections titled “class perspectives”:

“Class perspective” Viewed over the long run, new forms of financial capital are reducing jobs:

Think about each form of financial capital touted as a pillar of the “new economy”—their distinguishing feature is their lack of capital. Financialised corporations like General Motors package up debt instead of efficiently producing cars, banks don’t hold enough reserves to survive a run on cash, financial markets rely on recycling short term liquidity, hedge funds can’t cover their derivatives positions. Their fees extract value from production, creating the conditions for crises without the assets to survive a crisis. Counting the costs and benefits over the long run—the whole cycle of boom, bust and recovery–these new forms of capital reduce productive investment.

Today’s global internet companies also lack capital assets; they aren’t providing a physical service which justifies the scale of fees extracted from the owners of hotels and the makers and distributors of products. These businesses create market dominance by centralising consumer access to services, then like Booking.com they take an outrageous 15% of sales revenue from the companies that actually provide the accommodation, for the privilege of not excluding them from their global filter on bookings. Their monopoly power is written into the contract by forbidding participating providers from independent advertising below Booking.com’s marked up rate.

Financial and virtual capital can easily transfer funds from nations producing services to corporate tax havens, is easier to site offshore, and adapts quickly to circumvent laws and minimise taxation. This is what unregulated global capitalism looks like—not much capital behind the financing arrangements or the intellectual property, a burden on the real economy, few jobs inside these sectors and reduced jobs in the real economy.

Productive capital, or capital stock, relies on physical assets to enhance the efficiency of our work producing goods or services. Increasing the national capital stock used to be the top priority for capitalist economies, because this reinvestment of profits creates new jobs and new income. Free markets used to mean competitive production, not this new freedom to extract monopoly profits and financial fees without contributing to employment and efficiency. To reverse today’s cycle of crises and inequity, economics needs to refocus on productive capital.

Crises and bailouts

Crises create a window of opportunity to return to stable capitalism but our post-2008 response was directed primarily to weaknesses in the global financial system—complex money markets dependent on short term funding, collateralised lending practices, banks and investment banks too big to fail. The world has now spent most of its collective government crisis capacity to address financial weaknesses rather than productive weaknesses. Then, instead of removing the excessive stimulus which had created the problems, we delivered much more of the same.

The most effective responses were largely omitted in the rush to prop up existing financial institutions. Capital write-downs for investors in unsound businesses, break-up of “too big to fail” corporations and monopolies, limiting bank and derivative risk, structural incentives for long term investment, taxing and limiting short term bets like carry trades and property speculation, developing counter cyclical interventions, new currency settlement systems, more democratic global governance—these largely remain outside our public policy priorities.

This guarantee for business-as-usual is the worst possible response because today’s economy creates extreme inequality, and growing inequality is itself an economic problem. Extremes in wealth aggravate cyclical imbalances—the rich can cancel luxury spending and trade their investments for American cash in a crisis, but the poor still have to cover their living costs. The call is always for structural reform (read “wage cuts”) after a crisis; cutting executive excess and preventing parasitic financial profits are far more relevant structural solutions.

In developing nations, the collapse of Asian financial markets in 1997 followed by western financial markets in 2008 provided a huge incentive to grow their internal capital base while limiting foreign investment and short term capital flows. New lessons have been learned from this latest crisis, with widespread rejection of the failed Washington Consensus. Avoiding unfair trade and investment agreements in the post-crisis scramble for export supremacy will be the next test of this newly found independence.

2008 remains an important lesson in one aspect of managing crises though. Since no amount of free credit was sufficient to get financial markets back up and running, governments simply had to take over and directly provide both liquidity and equity to failed free markets. The world would be more stable and the vast majority better off if state and global regulation returned and the incentives for cyclical instability were reversed. Can these reforms happen in western economies? We won’t know until we see the size and shape of public responses to the next crisis, but to make a difference we would need much more public engagement than we’ve had to date.

Personal story Crises and recoveries:

It’s a strange thing to admit but when I was told I had prostrate cancer my first thought was that some good will come of this; when the body is finished dealing with pain, the mind kicks into overdrive. I conceived Marx2 while in hospital recovering from a cycling accident, I finished and distributed it while recovering from this second operation. But I don’t know the end of that story yet; sometimes personal crises bring more pain than gain and the same is true of social crises.

In my lifetime I’ve seen first hand the cost of uncritically adopting free markets in tiny New Zealand and free financial markets in Asia. Every crisis is shaped by the society we create when we close our eyes and minds and edge closer to the next precipice. And since 1980 we have done a very good job of undermining our institutional contributors to social equity and transfering power to profit-driven transnationals.

How we respond in periods of rapid change can still be critical though. During cancer I had to read research and seek expertise, choose surgery, do the rehabilitation program, then I had a rethink about what I wanted from the rest of my life. Even coming from pain, these moments when we change the course of our lives can be high points.

Crises are an opportunity which can go either way. After America’s early wild-west capitalism and the 1930s depression, Franklin Roosevelt and his supporters were able to push through wide-ranging changes towards a more egalitarian United States. In this century the rise of independent voices in developing nations gives me hope that self-serving American solutions can be pushed off centre stage; that we can increase global equity again.

Economy: Future prospects

Class analysis can bring a new perspective to understanding crises by reminding us that the rules governing capital can change, not just the conditions for labour. When financial markets crash again and national governments lack the capacity for a new round of stimulus, what might be the emergent responses? More stimulus or a shift to sustainability, global debt issued by the IMF or regional development stimulus from emerging Asia, bailouts or breakups, European Union exits or equity, better or worse national and global governance?

This next decade will be a critical time. Working people—which includes the “middle” class—face an uphill struggle in a world which has turned radically against us, where our jobs are much less stable and our government is much less effective. We need to reorganise and assert ourselves again—nobody else is going to create a safer world for us—but increasing global equity will take more than a return to traditional male working class militancy. Unions also need to become more professional, democratic and women friendly because working women lose most without effective organisation. Increasing gender equality in the poorest nations would make a big contribution to both equity and economic development.

Global corporations may seem to hold all the cards, but they are also flawed and unstable. In the long run the future could still belong to nations which learn from our global experience to create stable and productive national economies and regional blocs. All national governments and all citizens need to pay more attention to understanding these problems, not riding each new bandwagon to crisis. The future we get, for better of for worse, will be the one we have created together.

Production: Equity priorities

- Promoting evidence based economic models in developing nations

- Democratising and diversifying institutions of global debt management

- Incentivising long run productive efficiency over short run asset inflation

- Removing monopolies and restoring competition by limiting corporate market share

- Restoring corporate taxation for transnational corporations

- Minimising financial and commodity speculation

- Re-evaluating the costs and benefits of export economies and open capital markets

- Rebuilding efficient, effective and democratic workers’ organisations

- Employment schemes for unemployed youth