Overview

It was the best of times, it was the worst of times. It was the age of wisdom, it was the age of foolishness.

—Charles Dickens (1859)

We are heading for hard times again—many of us sense this. The global economy has turned to chasing short term profits, neglecting long term investment and undermining stability. Regulatory restraints were swept away to create this new “free market” world of tax-avoiding transnational corporations, globally integrated supply chains, shadow banking and hedge funds, speculative bets against commodities and currencies, financial manipulation replacing productive reinvestment.

Chart 1: Scale of financial speculation

The efficiency of free markets has become the foundation for contemporary economics, so western governments are advised to print more money and re-stimulate their markets. Once again we see a bubble building and another bail out ahead, nations chasing the short term advantage without considering the long term consequences.

Public debate is reduced to slogans—“Japan must ignite inflation to restart its economy”, “America should maintain stimulus until unemployment returns to its natural rate”, “Greece needs to maintain a budget surplus of 9% of GDP until 2023”, “global inequality is a key challenge”. Complex distributional problems are reduced to simple numbers, avoiding discussion of the causative mechanisms and alternatives.

How did we become so out of touch with the state of our economy? We are all strongly influenced by the organisations which pay us, and organisations across the world have adapted to the pursuit of short term gains. We have absorbed the spirit of the era and accepted the glib justifications. Since the 1980s we’ve been told that class was dead, so we watched passively while a growing financial sector took ever larger shares of the rewards created in production.

When profits are strikingly high without efficiency gains, this is not innovation and reward – it’s a giant sign saying something has gone wrong. Unearned profits don’t come from nowhere, they are transfers from one class to another, created by some combination of market manipulation and monopoly, leverage and risk, speculation feeding off instability, regulatory and tax avoidance, lowered wages. In this unstable new world, Marx’s method could re-emerge as a critical tool for social analysis because it reminds us to ask these essential questions—who profits from social change and where do their gains comes from?

Karl Marx described the 19th century struggle between owners of capital and labour to control the work process and distribute the relative shares of productive income. This approach of asking “who benefits from work done and how” can also be extended beyond productive work to include analysis of all forms of human work. If we drop Marx’s old jargon and “inevitable” socialism, but keep his focus on analysing changing roles and rewards, we can build an integrated explanation of financial capital, patriarchal cultures, political dynasties, dysfunctional democratic movements, military hierarchies and resource exploitation to guide us in the pursuit of global equity and social stability.

Part one (work) starts with the standard model of competitive production, where labour and capital struck a reasonable balance to support increasing living standards up to 1980. After the introduction of floating exchange rates, market volatility increased and the focus of western production shifted increasingly to short term profit. Executive salaries were linked to share prices and corporations abandoned local production to shift factories to low wage countries and profits to tax havens.

Financial capital created new sources of profit by selling collateralised debt and derivatives to insure against price movements, but derivatives themselves increased volatility—a major new class of capital had emerged. Western elites profited and free market economics gained credibility, creating a fertile environment for the national and international speculation behind the global financial crisis. Part one concludes by refocusing on the requirements for stable efficient production.

Chart 2: Cost of financial speculation

Part two (home and family) applies the same emphasis on analysing mechanisms of social transfer to Home and Families. Inter-sex inequality and transfers may appear to be personal and smaller scale when compared to production or global resource depletion, but they affect everyone; summed together they have global impacts. National cultural norms for families limit female participation in higher paid work; declining family size and aging populations reduce the tax base; entrenched male military and paramilitary cultures in countries as diverse as Israel and Sudan foment regional instability. Differences in the family affect the nation.

Part three (nation and government) reviews national and international institutions of government, whose work is also shaped and influenced by many forms of social transfer. Though we are in the first stage of a completely new form of international economic crisis, governments’ growing integration with income streams from the new economy has reduced their capacity for informed independent regulation, while our global governance institutions are even less democratic.

The most important function of governments is to provide stability by moderating excessive social transfers, whether nation, class, sex, race or resource based. Crucially, governments are now less financially viable, undermined by declining corporate taxes and burdened by bailouts and debt-funded stimulus. Just when effective governance will be essential for global stability, the capacity of governments is undervalued and at risk.

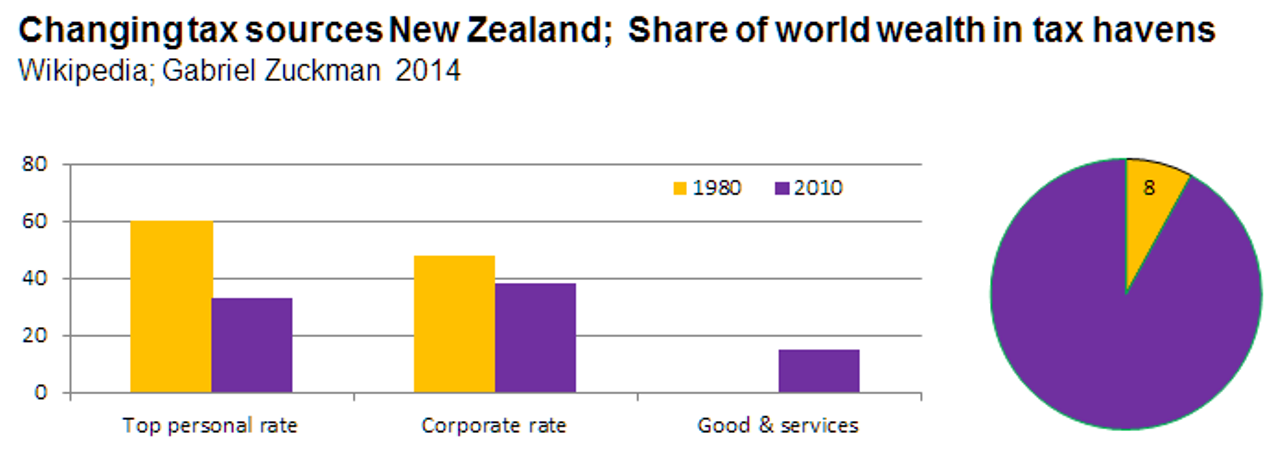

Chart 3: Personal and corporate tax rates & Use of tax havens

Part four (politics and community) looks at community governance and the capacity of popular initiatives to positively influence social equity. Short term forms of protest like the Occupy movement create an outlet for anger but no new solutions, so part four looks at new opportunities for community based governance to influence state and international government. The framework for this section is also based on examining social transfers, so the focus is on community organisations which are more egalitarian and therefore more likely to reduce social inequalities.

Part five (nature) considers human use of nature’s resources. Rapid economic growth and rising resource consumption over the past 30 years have also created social transfers, this time from sustainable use by future generations to wasteful exploitation today, from the earth’s stock of non-renewable resources to human consumption. Stocks of oil, coal and other critical resources are declining so future supplies will cost more to extract, yet growth remains the economists’ recipe for solving economic crises. Continuing state-funded stimulation while the costs of production rise only aggravates instability. Our economic aspirations have to become sustainable.

Part six (together—an integrated world view) discusses the interrelations between production, reproduction, governance and ecology and the value of an integrated class analysis to understanding our present and shaping our future.

Personal stories New Zealand and Australia

These are the countries I grew up in, influencing my early view of the world. New Zealand is a small nation of 4.5 million, with a relatively unscathed natural environment and an economy built on agriculture and tourism. We inherited effective government institutions as a late colonial conquest of England, created a culture of independence after world war two, then adopted free market economics with unusual enthusiasm after 1980.

Australia, with a population of 23 million on an isolated continent, is one of the richest and most stable nations in the world. The economy is built on resource extraction with limited industrial value-adding. There are two tiers of government, national and state, which slows the pace of political change.

New Zealand and Australia’s very different approaches to economics meant I lived through an interesting case study on the benefits and drawbacks of recent economic policies. Both countries also had active feminist movements in the 1980s and both now have emerging green parties.

Back in 1979 New Zealand introduced carless days to cope with oil price shocks. Few families had more than one car and carpooling developed to fill the gap, with the benefit of more social commuting. And in Australia’s long drought of 1995-2009 we cut water use radically. Experiences like these show that reducing cultures of waste is easier than it looks when change becomes necessary.

In 1984 a newly elected Labour government opened up New Zealand’s protected economy. Bruce Jesson, a republican radical, was elected chairperson of the Auckland Regional Services Trust, an organisation set up to fail so that the assets of New Zealand’s largest urban council could be privatised. A mix of committed business and community representatives on the board worked together to make the trust a success, repaying debts out of revenue and removing the justification for selling off the city’s assets. This was an inspirational example of how government can deliver services efficiently and equitably, even when free market ideology dominates economic thinking.

By 1997 I was working for the department of corrections (prisons) and absorbing the era’s emphasis on free market social solutions. I got a big wakeup call when we took a long holiday through Malaysia just after the Asian Financial Crisis hit. Driving past mile after mile of abandoned half-finished buildings and reading stories of forced repatriation for migrant workers was an experience I can’t forget.

For the last fifteen years in Australia, my life has been like most people’s, dominated by work. I try to keep some balance through fitness but that too caught me out as I aged. After a serious cycling accident I spent a lot of time in hospital. I doubt I would have had time to think back over my life and write this, without that accident. We forget how much work dominates and compromises our lives, because we have so little energy left for considering alternatives.

This is a new era and a new world is being shaped, so make the time to reconsider your past, present and especially your future.