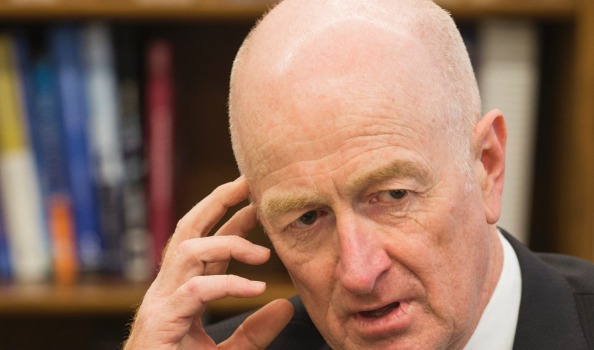

Retiring Reserve Bank governor speaks frankly

“The world’s major central banks are undoubtedly keeping an eye on exchange rates in setting their monetary policies”; on 2008 “you could get the sense that the world was teetering a bit”; on if quantitative easing would work for Australia “I’m very much hoping we never need to find out”; on the global economy “it’s probably not quite on the right path”:

Big central banks target exchange rates

The world’s major central banks are undoubtedly keeping “an eye on exchange rates” in setting their monetary policies, according to Reserve Bank governor Glenn Stevens speaking just before he retired.

The issue is a highly contentious one in international circles. Leaders and central bankers from the Group of 20 largest economies have repeatedly vowed to avoid a major currency war by refraining from depreciating their currencies to make their exports cheaper in global markets.

But critics allege the extreme monetary stimulus measures, such as negative interest rates and massive bond buying programs, which both the Bank of Japan and European Central Bank have adopted, are chiefly designed to depreciate their currencies in the hope that stronger exports will bolster economic activity. The scrupulously fair-minded Stevens acknowledged this criticism had some validity.

“I think you can be forgiven for thinking…that’s at least part of the channel they’re looking for,” he told The Australian Financial Review. It’s not the done thing in polite company to say that, and everybody has to motivate what they’re doing by their domestic objective…but I don’t think it could be denied that people have an eye on exchange rates when they’re making these decisions.” He added “to deny that would be to deny the obvious, I think”.

Mr Stevens also said that Australia could not hope to insulate itself from the effects of the monetary policies being pursued by the major global central banks. “In a world of capital mobility, which is the world we’ve been in for some decades, what the major countries do with their policies is always a constraint at some point.”

The interest rate policy of major global central banks, he said, “gets reflected in currencies but probably more broadly as well. And this imposes some limitations on what actions the Reserve Bank can take. Not that you slavishly have to do everything they do, but when the central banks are on a very strong course, you’re going to be affected.”

He added: “You can try to chart your own course to a certain extent, but there’s a limit to how much you can do that, I think, realistically in a world where capital is mobile.” In terms of the Reserve Bank, he said, “that doesn’t mean we’re completely impotent to do things for our own good, but it’s just you’re not an entirely independent agent either in that world”.

Mr Stevens said it was difficult to know the extent to which the Reserve Bank’s rate cuts had weighed on the local currency. “It’s very hard to be precise, because there are so many other things affecting the exchange rate, so identifying the interest rate effect is, you know, really a mug’s game.”

But, he added: “I have to believe that having lowered the cash rate for five years and also made the odd comment, the exchange rate is lower than it was going to be otherwise. The terms of trade are taking it down as well.” Mr Stevens also signalled he was relatively relaxed about the level of the Australian dollar at the moment.

“I think it’s doing its job,” he said. “You know, when I started this role it was about where it is now. It has moved a lot in the interim.”

Looking back on 2008

On the morning of October 8, 2008, as the global financial markets spun ever more rapidly out of control, Stevens came to the realisation there was no longer room for half-measures. It will forever be the moment that defines Glenn Stevens’ decade as governor and cemented his reputation as a bold mover in the world of central banking.

On the morning of October 8, 2008, as the global financial markets spun ever more rapidly out of control following the collapse of Lehman Brothers a few weeks earlier, Stevens came to the realisation there was no longer room for half-measures.

Having just days earlier prepared to recommend his nine-member board approve a 50-basis point rate cut, Stevens sought the advice of his closest colleagues one final time.

Deputy governor-select Guy Debelle – who headed the central bank’s markets division where the turmoil was most vivid – told Stevens it was time to consider a bigger move. “It was pretty clear that this was going to be a very big event and we were going to need to ease a lot,” he told The Australian Financial Review this week in his final interview as governor.

Recalling that the Lehman’s aftermath – on markets and confidence was rapidly starting to become “pretty violent” – Stevens decided to do what has become habit when when faced with a diabolical choice.

He started by writing two press releases. In this case, one for a 50-basis-point cut and another for a reduction of twice that much and the biggest single move in the inflation-targeting era. “I often did this, where, considering a couple of courses of action, one of the tests is can I write a convincing statement … of course hoping that when we press the button to go we actually send the right one,” he jokes.

Stevens said his board members assembled in the central bank’s dealing room after the traditional post-meeting lunch to watch the impact of the supersized cut on financial markets as the news was transmitted at 2:30 pm.

The stakes were sky high. Would it be seen as too little, too late, in a world spiralling towards the greatest economic crisis since the Great Depression? Or would a major decrease in the cash rate add to the panic?

“That’s always true, but in the end, you can’t let the possibility that you will be misunderstood prevent you doing what has to be done. Otherwise you would always be behind,” says Stevens today.

Heart-in-mouth, Stevens and the board stared at the trading screens, watching the market rally. Success, for now, even if the gains unravelled in subsequent days as more bad news thundered in from abroad.

But the key thing about that moment was that foreshadowed another four cuts over five months to lower the cash rate by another 300 basis points to what was then described as an “emergency-low” of 3 per cent.

Critically, his bold action on that October day had two immediate effects. It sent a message to the broader world that Australia was prepared to use its monetary policy ammunition, leading the world’s central banks in the process. Second, it destroyed any remaining complacency about the seriousness of the crisis.

Then Treasurer Wayne Swan recalls that news of Steven’s double-sized cut – filtered through as Cabinet sat in Canberra – helped galvanise remaining doubters within the government of the need for significant action, particularly fiscal stimulus.

Looking back eight years after the crisis, it’s easy to forget how close it felt to the end of times. “It was a period where every day you would come to work and there had been something happen overnight; and you could get the sense that the world was teetering a bit.”

Stevens, who is still reluctant to go into details, says he spent the whole weekend on the phone with his counterparts around the world in an ever more desperate fight to keep abreast of the crisis. “At times like that, the central bank’s job is to make sure everybody who needs funding is going to get it from somewhere.”

One of the biggest priorities in those frenzied days and weeks was to stem the growing tide of fear ordinary Australians had in the security of their bank savings. Again, Stevens was instrumental in bringing focus to the debate, according to people who were there, particularly in the lead-up to the infamous two-day “kitchen cabinet” over the weekend of October 11 and 12, when the crisis had reached the point of no return.

Aside from agreeing to unleash an unprecedented stimulus package to buttress shattered consumer confidence, the government decided that the issue of a bank guarantee could no longer be left unresolved. Stevens confirmed in his interview that policymakers were caught off guard on this point, having taken too long to develop a financial claims scheme that had been in the pipeline for several years.

“Glenn was extremely calm – I thought remarkably self-assured,” said one observer. “It was during that week [before the October 11 & 12 meeting] that at some point he decided ‘look, we really have moved into the world of guarantees. At some point, the government is going to have to announce one’.”

Deeply unsettling stories abounded, Stevens recalls, from anecdotes about people walking out of banks with millions in cash, to a rush of Armaguard vehicles scrambling to satisfy demand for banknotes.

“You were getting troubling things like people ringing up radio shows to ask: “Is my money safe in bank X?”, where X might be a pretty large bank. “People are observing major global financial institutions going to the wall or being guaranteed by their governments. So it’s not surprising that people would be pretty tense.” The greatest fear was that there would be a rush on banks as had happened with British lender Northern Rock a year earlier.

Making life difficult was the growing political escalation around the size of the guarantee. The original proposal – cooked up well before the crisis – had been for a more modest claims scheme of between $20,000 and $50,000 to reimburse customers in the case of a liquidity crunch.

“We had been working on the financial claims scheme for a long time, but that actually hadn’t been on a fast-enough track, in hindsight,” says Stevens. While many other countries already had such a guarantee, in Australia the situation was vague, with surveys showing most people had mistaken ideas around who would bail them out, including some who said it would be the Australian Bankers Association, a lobby group.

“There was once a time when it was thought constructive ambiguity was good,” says Stevens. “The crisis hit before all that was really properly worked out, so we had to accelerate that.”

It fell ultimately to Kevin Rudd and Wayne Swan, who announced on the Sunday that the government would protect deposits up to $1 million, a figure that drew criticism for being excessive, and certainly far higher than the $250,000 figure then opposition leader Malcolm Turnbull had called for. “I remember sitting in church, but sitting at the back because I was expecting the phone to ring,” Stevens says of October 12.

While there have been criticisms of the size of the government’s guarantee, Stevens defends its magnitude because it ultimately calmed depositors, which is “99 per cent of what matters”. “If there’s actually an incipient panic, you’ve got to overkill. I think that’s the lesson from the UK experience.”

Stevens still struggles to describe the violent shift in thinking that the crisis imposed – from the normal day-to-day “increment mode” of regular central banking to the big-stick action required to avoid Armageddon. It’s an experience he hopes will be a “once in a lifetime” event.

“At those moments you’re drawing on all the skills and experience you can find around you and making the best call you can. “That’s what they were doing in Canberra, and as it happened, we had people leading the Treasury who had been through other big economic episodes and who had some pretty well-developed views about the appropriate fiscal response. “That was to the country’s advantage.”

Looking back, Stevens says he has no regrets about his time as governor, even if he jokes that he would probably be “a bit wealthier” had he taken any of the many private sector offers made during his 36 years at the bank.

“I was given the opportunity to lead a fantastic institution for 10 years, and people seem to think we’ve done a reasonable job. How could you regret that?”

On quantitative easing, quoting direct from the interview:

AFR: So in this world of QE and unorthodox policies, how does that work for us if we find ourselves pulled in there? How would QE work here?

Mr Stevens: Well, I’m very much hoping we never need to find out. We’ve certainly observed what has been done elsewhere, and there’s any number of assessments around on its effectiveness.

AFR: How would you rate its effectiveness?

Mr Stevens: That’s a difficult question. And I preface any answer by saying I’m very thankful not to have been in the position that they were in of feeling that we’ve got to do more. We haven’t been in that position, and hopefully we won’t be. My answer to the question, I think, is that in countries where long rates matter a lot – and in Australia this is not such an such an issue. Because a lot of our lending keys off shorter rates. But in the US or Europe where long rates drive mortgages very directly: OK, you’ve brought the overnight rate down.

The next thing you could do would be to actually directly bring the longer rates down, and that probably was stimulatory initially, I think. Once you get into later rounds where you’re looking for effects where the central bank takes the lowest-risk assets out of the system and the investor who used to hold them is now holding something that’s slightly – not quite so low risk, but probably still pretty low. And the intention is that out along a chain of transmission, other stuff happens.

My test is: “Who went to Bunnings in the end as a result of that? Did someone go and take borrowed money and spend it on real goods and services that wasn’t going to otherwise? Because that’s actually in some sense the ultimate test. Did we create some additional demand?” It’s impossible to know really, but I suppose I’m left with some doubt that all that many people went to Bunnings that weren’t otherwise going to. Maybe and probably the US would have the best case that that happened. But I think for me to take a bond off you and give you another asset, namely cash, which is more or less a perfect substitute, and expect that you’ve then had a major behaviour change – you know.

AFR: How would you judge the transmission mechanism works here now, when you’re cutting cash to such low levels?

Mr Stevens: I think on the work that I’m aware of, the evidence that I’m aware of, I would say that cash-flow channels still probably work. I’m personally of the view that maybe not as strongly as they used to, because I think the evidence is that the borrower households – that’s where the action comes from, and the way this is supposed to work is the borrowers have more debt than the savers have deposits. That’s a fact. And when you change rates the borrowers are the ones who are, you know, spending all their income, and if I give them a bit more income. They’re likely to spend that. And the savers – the cut to their direct income is actually not as big, and they’re less likely to respond.

That’s still true. But I think more of the borrowers are actually using the low rates to accelerate the repayment rather than going to Bunnings. Now, what that does is it’s accelerating the decline of the debt for those individuals, those households, so the day when they are freer of the debt or have a lower debt and they’re then more confident to spend – that day is getting closer. But it probably hasn’t been as much of an immediate effect maybe as it might once have been. And I’m hypothesising here. You can’t prove this.

AFR: Is that day getting closer, or are people just re-mortgaging, buying bigger houses?

Mr Stevens: No. Well, credit growth slowed down in the past year, really. So I think a lot more people are intent on trying to get to the point where they’re carrying a lower debt load. It’s the new people borrowing to come into the market that, you know, keep credit growing at all. So I think what’s driving that is just people have changed their opinion about how much confidence they have in future asset values rising and how much leverage they’re prepared to hold. I think a lot of people thought: “I’m going to be more careful.”

AFR: So a demographic factor, as well.

Mr Stevens: I don’t know. Maybe. I think it’s probably largely that people have looked around the world, and there has just been a mind shift change.

Ten years ago, you know, we were very confident. Asset prices were rising. Leverage was rising. Saving was falling. Saving rate was falling. And there has been a complete – a very substantial change in people’s psychology. That was bound to happen, actually. It began in about 2007. Looking back. It took some time to come through all the figures. But it’s probably a good thing, in most respects.

On today’s economy:

AFR: One of the motifs of your two terms as governor has been a glass-half-full message. Are you concerned at all that there’s a certain complacency in Australian life that you referred to in a footnote of a recent speech? Are we getting too complacent about the 25 years of economic growth that we’ve been through?

Mr Stevens: Well, we like to celebrate the 25 years of expansion, and we should. That’s a remarkable run. And you know, we’ve had a little bit of luck on occasion there, but we’ve had some other things that have helped us as well. So the conversation we ought to be having is how did we achieve that, how did that actually occur – when we did have brief downturns, why were they brief and shallow and how was it that we got going again quickly and how do we make sure that we can do that again if needed. I think there is some risk that the long period of growth may be leading all of us as a community to somehow think that’s just the natural state of affairs, that we don’t need to do anything to achieve it.

That’s not really so. It’s not a game. It’s not a sporting event that we like to spectate on, but then in the end it’s just a game. It’s real. And we do need to make sure that we are having the serious conversations about things that will help the supply side of the economy; things that will make sure that our fiscal position, which is – it’s OK, but it’s probably not quite on the right path, as I’ve said before. We need to make sure we’re having the right conversations there about being on the right track, so that in future episodes we do have the flexibility that we had in previous ones.

Supervision is as important as reform

RBA governor Philip Lowe, who replaced Glenn Stevens at the RBA on September 18, has warned that strengthening supervision of markets and the financial system is just as important as regulatory reforms such as the Basel suite of reforms in the banking sector.

Mr Lowe said that while regulation can be “printed, measured and enforced” the “strengthening of supervision is at least as important as are the post-crisis regulatory reforms”.

Ahead of a meeting later this week of the Basel Committee on Banking Supervision which will discuss reforms to how banks model risk, Mr Lowe said “rigorous, inquiring supervision that takes a holistic view of the environment is essential to maintaining financial stability and good outcomes for consumers.”

Mr Lowe also raised the question of whether new methods should be employed to monitor financial cycles, noting that while it “has become common practice to start by looking at cycles in credit growth” this is now too limited.

“In my view, it is probably more useful to start with the question: are balance sheets in the economy being strengthened or weakened? If credit is growing quickly, we need to think about whether the credit is being used to create new productive assets or simply to finance current consumption.

“The implications are quite different. A protracted period of balance sheet weakening might reasonably be viewed as problematic, particularly if it increases the probability of future balance sheet strains and weak economic growth.”

James Thomson James Eyers AFR 8 Sept 2016