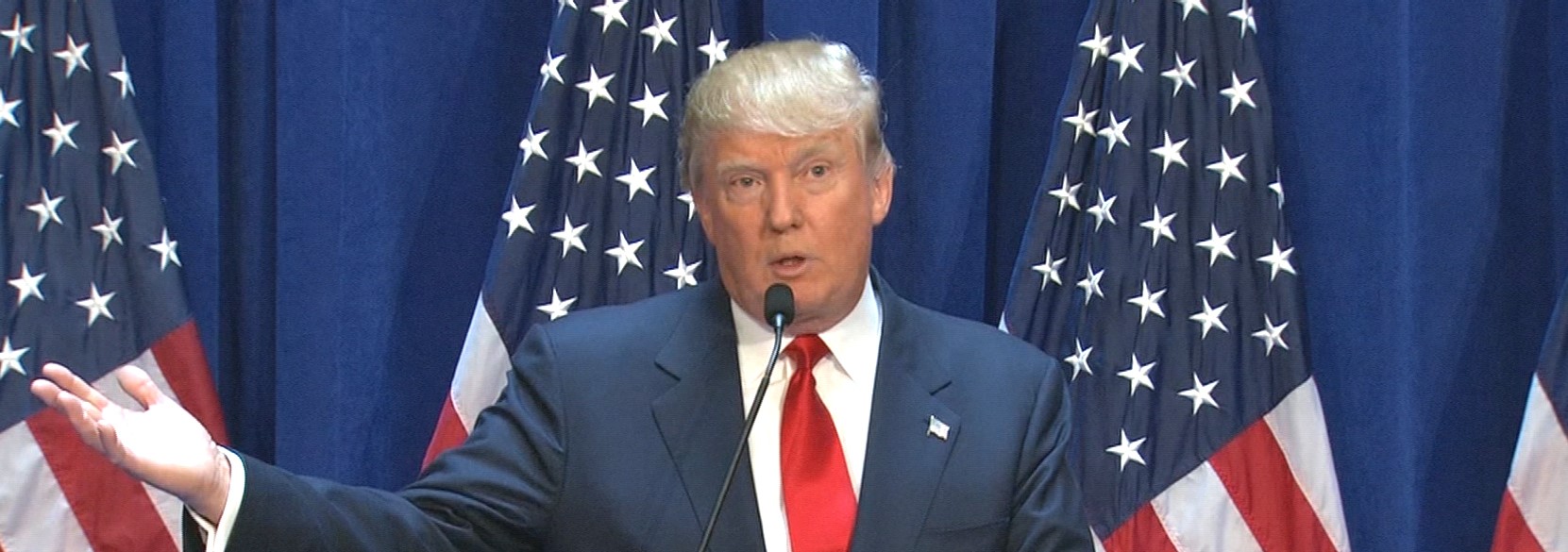

The Trump road map

1) start a global race to the bottom on corporate taxes 2) bring the untaxed profits of American transnationals back home 3) use tax changes to create import tariffs 4) raise global interest rates and inflation to erode American debt.

Robert Gottliebsen, the best economic writer at The Australian, has spelt out the Trump road map for “America First” and its consequences for the rest of the world.

His ideas were sharpened by talking to the managing director of Lazard (the world’s leading financial advisory and asset management firm, according to their website) about why Warren Buffett recently sold out of American retailing giant Walmart. Buffett has looked hard at the road map guiding us towards what President Trump is planning for the US and found that the challenges facing US retailers go way beyond the rise of online retailers like Amazon.

Gottliebsen: “The media elites have concentrated on the social/community measures of Trump. Our road map concentrates on business, where tax cuts are top of the agenda.

The Republicans in the House want to cut the US company tax rate from 35 to 20 per cent, which will cost a massive $US1.85 trillion (all dollar figures in this commentary are US) or 0.74 per cent of GDP over ten years.

President Trump wants to go further and cut the corporate tax rate from 35 to 15 per cent, which represents a cost of $2.35 trillion over 10 years or $500 billion more than the House Republican figure. The final tax cut may be somewhere in between. That’s tax step number one.

Step two in the tax cut is to make all capital investment tax deductible. That ends depreciation as a cost. Under the House Republican plan there will be no choices. Part of the cost will be recouped by not allowing interest as a tax deduction. Lazard estimated the net cost of the two measures (capital write-offs and non-deductibility of interest) is $US450bn over 10 years.

Trump has a slightly different plan. He wants to give US companies a choice. If you decide to depreciate you can also deduct interest for tax. The Trump scheme actually lifts the net extra cost from $US450bn to $US600bn.

In total, we are looking at the House Republican cost of $US2.3 trillion against Trump’s $US2.9 trillion over 10 years.

This system of tax is very simple but it means that if you can’t deduct interest, then high leverage no longer makes much sense (banks will surely get some relief). Private equity people are not at all happy because their model relies on high leverage.

A whole new game will take place in the capital structure of US companies. There are also foreign tax credit measures that add small amounts to the cost.

Step three is to suck the vast sums sitting in corporate accounts overseas, which American companies are not bringing to home because of the high US tax rates. Trump wants a 10 per cent tax on money coming home which Lazard estimate will raise $US150bn over 10 years.

The House Republicans have a more complex scheme which raises slightly less. Both measures are expected to bring vast sums back home to the US where they may find a much higher interest rate environment than is currently the case.

As a result, step four, which is how Donald Trump plans to raise the largest sums. In many ways step four is the most revolutionary: All import costs will be denied a tax deduction, which will raise a massive $US1.2 trillion over 10 years.

This is actually a House Republican measure which has not been fully endorsed by Trump who is also looking at tariffs because he can use them with devastating effect to force investment in the US. The House Republican plan seems to be interchangeable with higher tariffs but is much more elegant and easier to introduce.

Either denying tax deduction for imports or imposing tariffs is an essential part the Trump plan, although many believe it will never happen. They may be right but Buffett is playing it safe.

It is possible there will be some trading deal with Mexico and China to reduce or delay the impact but the non-deductibility of imports will raise $US1.2 trillion over 10 years or about half the cost of introducing Trump’s 15 per cent corporate tax rate. It is essential to the road map.

In all, Lazard estimate that the net cost of the House Republican Measures is $US890bn over 10 years, which is only 0.35 per cent of US GDP over the period and that GDP may grow at a faster rate. Trump’s measures cost more but not that much depending on what happens with tariffs and non-deductibility of imports.

If the Trump plan is introduced, then the effect on retailers like Walmart will be much more severe than international groups like Apple. US retailers selling imported goods will not be able to claim a tax deduction on their imports or will face big tariffs. Remember Walmart margins are much lower than Apple and, like other retailers, most of their goods are imported.

If nothing else happened, the Walmart profit would be hit very hard but in practice they will raise their prices. But online retailers like Amazon will curb their ability to lift prices. Welcome to inflation in the US. Already American inflation is stirring but the Trump road map sends it much higher.

Along with higher inflation goes much higher US interest rates. Historically governments have repaid debt via inflation. That’s what Trump is doing.

Of course, there will also be less demand for corporate bonds because as interest rates rise there will be no tax deductibility. US banks will benefit from the higher interest rates and the deregulation that also comes as part of the Trump plan. All American industry is thirsting for less regulation.

Whether it is via tariffs or via the simpler non-deductibility of import expenditure, the US would be breaking WTO rules. The Trump people say it will take five years to argue the point in the courts by which time Trump may be in a second term. The US may make it easy and leave the WTO.

So that’s the basic road map.

It will not suddenly cause all production to leave Mexico and China for the US because the labour costs are so much lower. And in the case of Mexico the decline in the currency has further reduced labour costs.

But I have no doubt that all major manufacturers in China and Mexico exporting to the US will be required to increase their investment in US plants to honour the Trump jobs pledge. If they don’t, they will soon find themselves excluded from government contracts or some other ‘nasty’.

It’s hard to know how long the process will take but Trump wants to move fast. Once Europe understands the US game there will be incredible pressure to follow. Ansell in Australia is looking to put a plant in the US and will almost certainly do so if Trump implements his road map.

There will be pressure in Australia to change our US trade deal. The sooner Canberra understands that the game has changed the better. We don’t win from this. As US interest rates go up so will the cost of those borrowing overseas — led by Australian banks — so there will be upward pressure on our rates … and so on.”

Source: Robert Gottliebsen, The Australian February 17, 2017